|

|

|

|

|

|

Introduction |

|

Improvised Money

-

Money as Message

-

Buying Time

-

MiffPellings

|

|

|

|

America's earliest forms of money were commodities, items that were not just tokens of wealth but had some intrinsic value. American Indians used strings of decorative shells, or "wampum," and furs as means of exchange. The cash-strapped colonists adopted this economic system. In addition to wampum and furs, they used crops and European-made items such as nails.

Small quantities of gold and silver Spanish American coins came to British America through trading in the Caribbean. The most common of these were silver eight-reales pieces, the "pieces of eight," that parrots squawk about in pirate stories. They were also known as Spanish dollars. The term dollar, of German origin, was applied to coins of any country that carried the intrinsic value of their weight in silver. Even before the Revolutionary War, some colonies issued paper money based on dollars rather than British pounds sterling.

Paper money first appeared in America in 1690, when the Massachusetts Bay Colony issued bills to pay soldiers engaged in campaigns against the French in Canada. This was an emergency measure, but it turned out to be a solution to the long-term problem of building an economy without large reserves of precious metals. Eventually, all of the other colonies issued their own bills.

This money never had a uniform value. A pound note from one colony might not be worth a pound in another colony. For that matter, it might not be worth a pound anywhere - ; some colonies printed far more paper money than they could ever redeem.

Further weakening the system was the circulation of counterfeit bills. Anyone with a printing press could make fair copies of most colonial money; government printers tried to stay a step ahead by creating designs of greater and greater detail for the borders of the bills. Another security measure was to "indent" the money - to cut a stub from the bill in an irregular, wavy line. The indented bill could be redeemed for coins at a government office if it fit the stub bearing the same number. The problem with this, of course, was that the bill had to remain in perfect condition to fit perfectly.

The most imaginative anticounterfeiting ideas came from the Philadelphia printer Benjamin Franklin, whose firm manufactured paper money for Pennsylvania, New Jersey, and Delaware. In 1739, he began printing bills on which he deliberately misspelled Pennsylvania. A counterfeiter, Franklin figured, would correct the spelling on the assumption that the bills were themselves fakes, produced by a less literate criminal.

The back of each of the bills featured an image of a leaf. Franklin worked with blocky lead printer's type, but the leaves, with their traceries of veins, had the fine detail of copper engravings. These "nature prints" succeeded in baffling counterfeiters, and everyone else as well. It wasn't until the 1960s that a historian discovered the secret: Franklin had made lead casts of actual leaves.

Franklin, our national symbol of thrift, was a strong advocate of paper money, which to some represented economic irresponsibility. He argued to the English Board of Trade that the colonial economy could not survive on coins alone. But the dramatic fluctuations in the value of colonial currency - not to mention the confusion caused by all the different notes - worked against the interests of British merchants. In 1764, Parliament passed the Currency Act, which prohibited any further issue of American paper money. Like the Stamp Act the following year, this attempt to impose control over the colonies succeeded only in uniting them in protest.

|

|

|

|

|

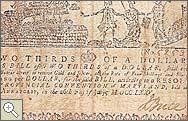

Maryland, July 26, 1775, front

|

|

|

|

|

|

|

Maryland, July 26, 1775, back

|

|

|

|

|

|

|

|